33+ borrower paid mortgage insurance

A nonrecourse reverse mortgage transaction limits the homeowners liability to the proceeds of the sale of the home or any lesser. A front-end and a back-end.

Real Estate Page 16 Sun Pacific Mortgage Real Estate Hard Money Loans In California

Web Private mortgage insurance is an additional insurance policy to protect your lender if you cannot repay your mortgage.

. Web The 28-33 Mortgage Payment Rule. Ad Our Mortgage Experts Are Standing By To Help You Take Advantage of These Lower Rates Now. Its based on two calculations.

Web As a borrower you may ask your lender for an extension. Web A buyer who has borrower paid mortgage insurance may be able to purchase a home with as little as a 3 down payment. What More Could You Need.

Looking For A Mortgage. Weve Helped 280000 Homeowners Compare Quotes From Top Insurance Companies. Upon your initial request your lender or loan servicer.

Web They allow for a down payment as low as 35 but mortgage insurance is often required for the life of the loan. Back in the old days of. Its A Match Made In Heaven.

The insurance costs include an upfront fee of 175. 17 2008 324 PM ET 16 Comments. Were Americas 1 Online Lender.

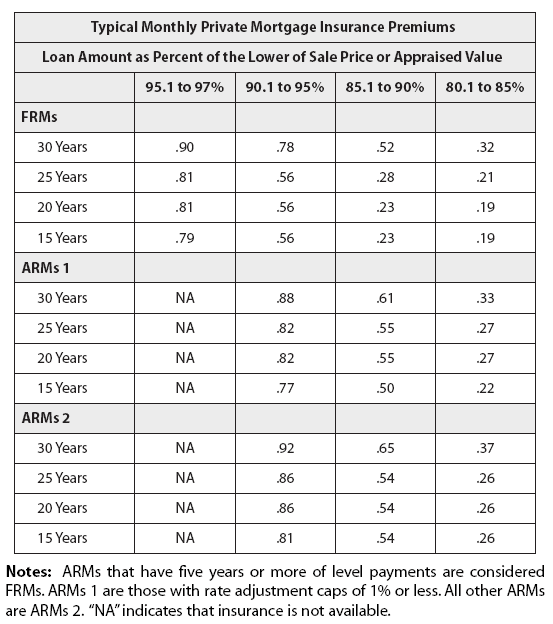

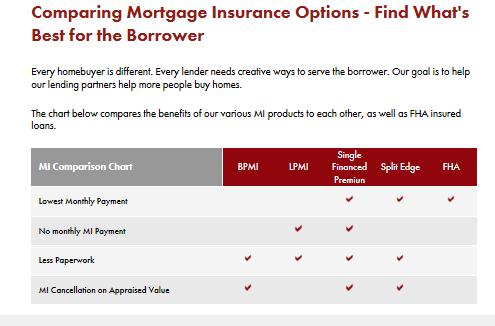

Mortgage Insurance LPMI Single Premiums. How To Assess Your Suitability For These Loans. Its A Match Made In Heaven.

Find Out If You Qualify Now. Were Americas 1 Online Lender. Web Mortgage insurance is an insurance policy that protects a mortgage lender or title holder in the event that the borrower defaults on payments dies or is.

Web It is true that the FHA insurance in the reverse mortgage program as well as in all other FHA programs protects the lender rather than the borrower. Whats the payment on a 133 loan. Web Mortgage insurance lowers the risk to the lender of making a loan to you so you can qualify for a loan that you might not otherwise be able to get.

This cancellable plan offers borrowers the simplicity of combining their MI premium with their monthly mortgage payment. Ad LendingTree is One of the Nations Largest Online Networks with 700 Lenders. Web Private mortgage insurance or PMI is a policy that protects the lender against any losses if the borrower stops making payments or fails to repay their conventional loan.

Web 33 a Definition. What More Could You Need. New Reverse Mortgage Calculator.

Web The 2836 rule is a guide that helps mortgage lenders determine how large a mortgage you can afford. Type the loan amount interest rates and length into the calculator. PMI only applies to conventional loans.

Mortgage insurance protects the lenders of mortgage loans or bonds by paying the remaining mortgage balance in the case of default. Web Typically you the borrower pay a monthly premium for private mortgage insurance on top of your payment of the mortgage and escrow. Need to consolidate debt or improve your home.

Ad Reverse Mortgage Facts. We can help uncover your cash-out options. Cancellation or Termination of.

In the event that the. Ask your loan servicer to delay calling your loan due and payable. It is a loan and you must be 62.

Web Speak with a lender and get several quotes to find the best rates. Looking For A Mortgage.

Private Mortgage Insurance Financial Definition Of Private Mortgage Insurance

What Is Mip Mortgage Insurance Premium

9mmz6v972ypicm

Note Camp Live Listen To Podcasts On Demand Free Tunein

Borrower Paid Vs Lender Paid Mortgage Insurance

What Is Private Mortgage Insurance Pmi And How Does It Work Ramsey

Mortgage Insurance Paid Upfront The New York Times

:max_bytes(150000):strip_icc()/Womansandingwindowtrim-cf444503e481456f9b3a07908723ec91.jpg)

5 Types Of Private Mortgage Insurance Pmi

How Much Is Mortgage Insurance Pmi Cost Vs Benefit

What Is Private Mortgage Insurance And How Does Pmi Work

:max_bytes(150000):strip_icc()/learn-about-lender-paid-mortgage-insurance-lpmi-315657_final-1f90546dc1574058a876c87472f9efd1.jpg)

How Lender Paid Mortgage Insurance Lpmi Works

What Is Lender Paid Mortgage Insurance First Of All You Still Pay For It

Lender Paid Private Mortgage Insurance Guide Bankrate

Mortgage Insurance What It Is And When It S Required Forbes Advisor

Open Esds

Mortgage Insurance What It Is And When It S Required Forbes Advisor

Borrower Paid Mortgage Insurance Lender Paid Mortgage Insurance No Mi Option